Live Market Intelligence Feed

Stop missing market-moving news

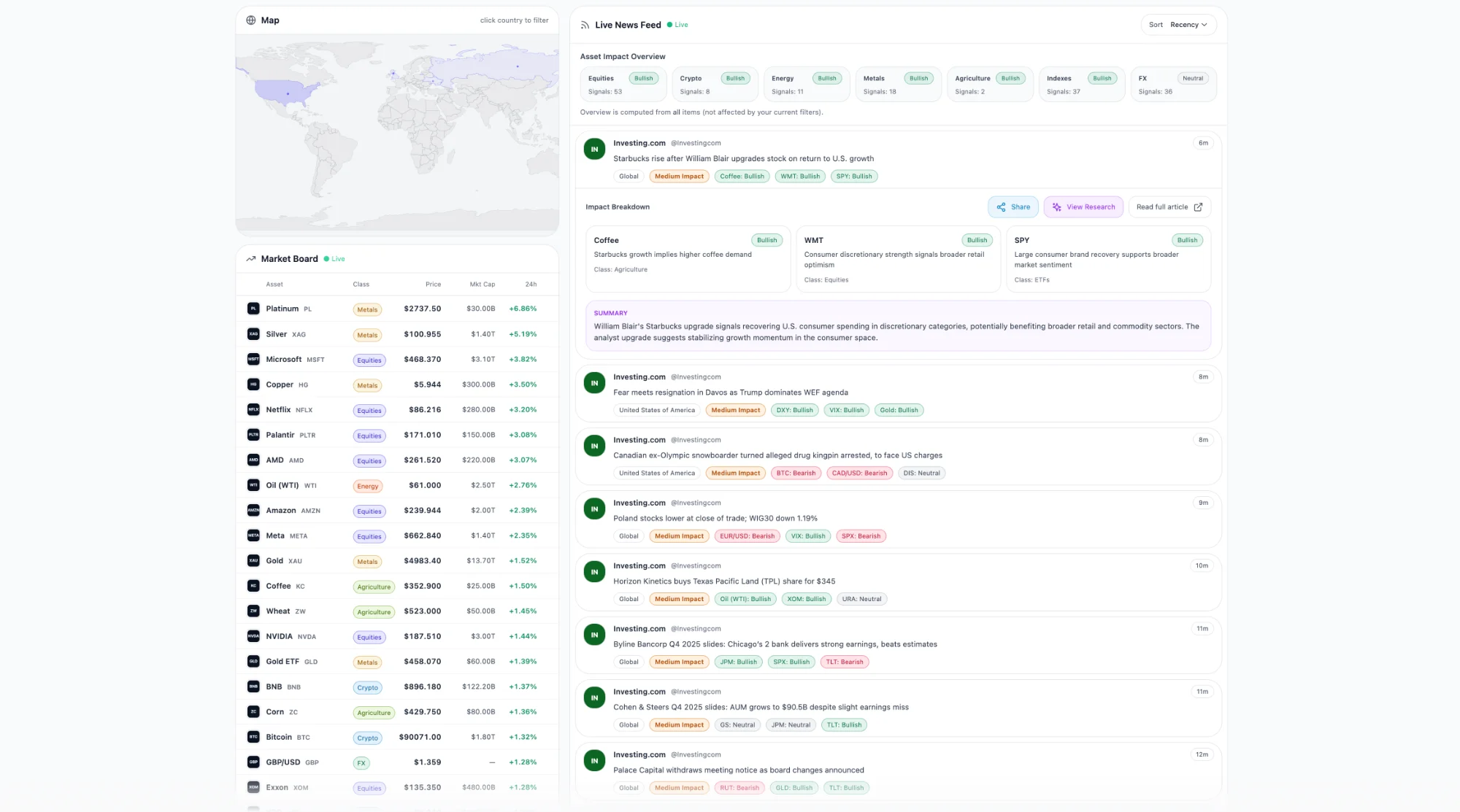

Sistine Research monitors global news and instantly analyzes market impact across crypto, equities, energy, metals, and FX. Know what matters before the market moves.

7-day free trial • Cancel anytime

sistine.ai/dashboard

Everything you need to stay ahead

Professional-grade intelligence, simplified.

Global Coverage

Monitor news from Reuters, Bloomberg, WSJ, and 50+ sources worldwide in real-time.

Impact Analysis

Instant AI analysis of how news affects specific assets with directional insights.

First & Second Order

See beyond the headline with cascading market effects most traders miss.

Simple, transparent pricing

One plan. Everything included.

PRO

$49/month

- Unlimited real-time news monitoring

- Instant market impact analysis

- All asset classes (Crypto, Equities, Energy, Metals, FX)

- First, second & third order effects

- Share insights to social media

- Cancel anytime

No credit card required to start

Frequently asked questions

Ready to get ahead of the market?

Join traders who use Sistine to catch market-moving news before it moves.