Don't Miss Gold

Gold has been consolidating for 77 days, forming another triangle. The previous one popped for +30% with limited pullbacks.

Here's the chart and why we think gold will continue to rise in price:

Potential catalysts and tailwinds:

- Trump tariffs and uncertainty around global trade policy (tariff deadline moved to Aug 1)

- Big Beautiful Bill passed, raising debt ceiling, printing likely to ensue, inflation concerns rising.

- Fed Open Market Operations (Fed injected liquidity on June 30, for the first time since 2020)

- Increasing geopolitical tensions (tariffs, Ukraine/Russia, Israel/Iran, China/Taiwan)

- Weakening dollar (DXY down)

- Central bank purchases by countries looking to reduce reliance on US dollar.

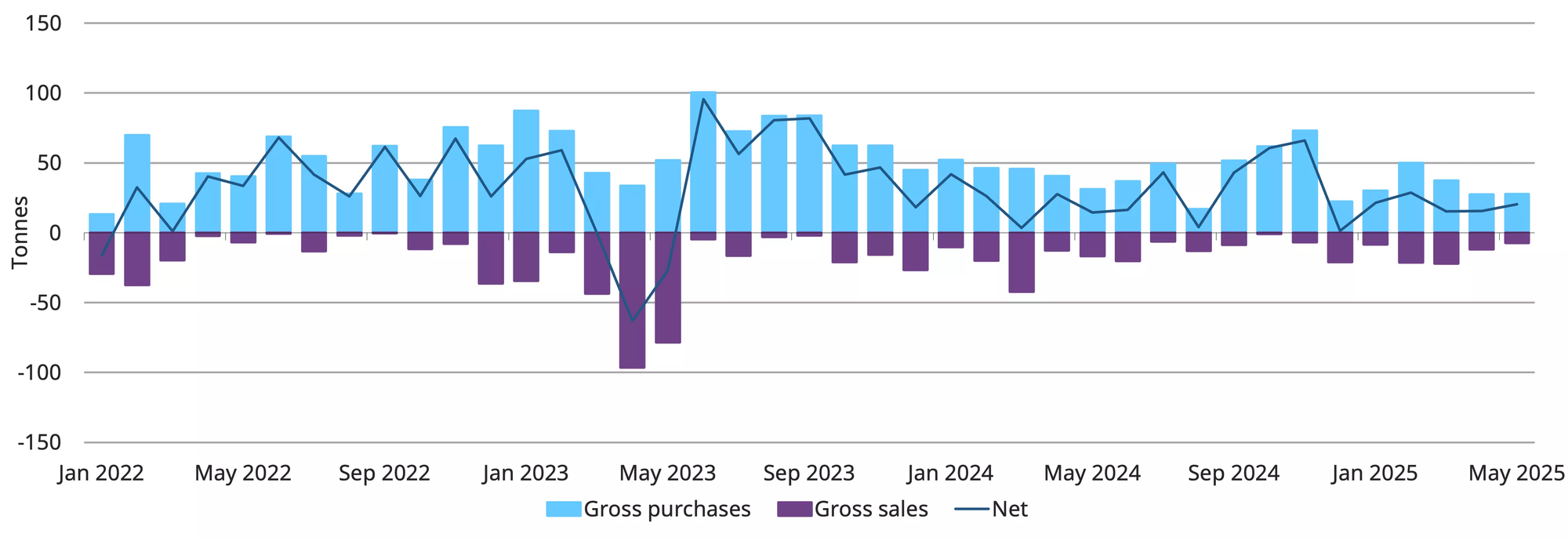

Central banks are net purchasers of gold since 2023: