Explaining Gold's Parabolic Run

I've seen a lot of a lot of poor attempts to explain gold's price action recently showing a lot of market participants do not understand the gold trade.

I'll do my best to explain the underlying mechanisms that are causing gold to go parabolic and why it is likely to continue in the coming months/years.

Almost every time we see a parabolic run on any asset, the usual explanation is rapidly expanding liquidity lines + a demand spike (generally on a supply constrained asset).

Gold is no exception here.

Essentially it boils down to demand for an asset increasing plus the ability for large amounts of money to flow into said asset.

Let's break it down.

Gold Demand Spike

Gold is seen as a debasement hedge, protection against inflation or declining purchasing power in fiat currencies like the Dollar or the Yuan.

If these currencies are projected to weaken due to excess printing of the currency, gold will generally benefit.

Enter Trump tariffs and trade wars.

Tariffs weaken the economies of both countries involved. A weaker economy means the government of that country is more likely to print fiat currency to stimulate its economy.

If Trump puts a 100% tariff on China, it makes Chinese goods twice as expensive for Americans to buy. This obviously leads to less Chinese good sold in America (Chinese economy weakens). It also means Americans have to pay more for Chinese goods, consume less, or find substitutes from other countries that are likely more expensive than the pre-tariff Chinese good prices.This leaves American consumers worse off and weakens the US economy as a result.

With both the Chinese and US economies worse off due to large tariffs, both countries are more likely to print to stimulate their economies, debasing their currencies in the process.

This is the fundamental reason for why investors run to gold when they hear the word "tariff" or "trade war".

Rapidly Expanding Liquidity Lines

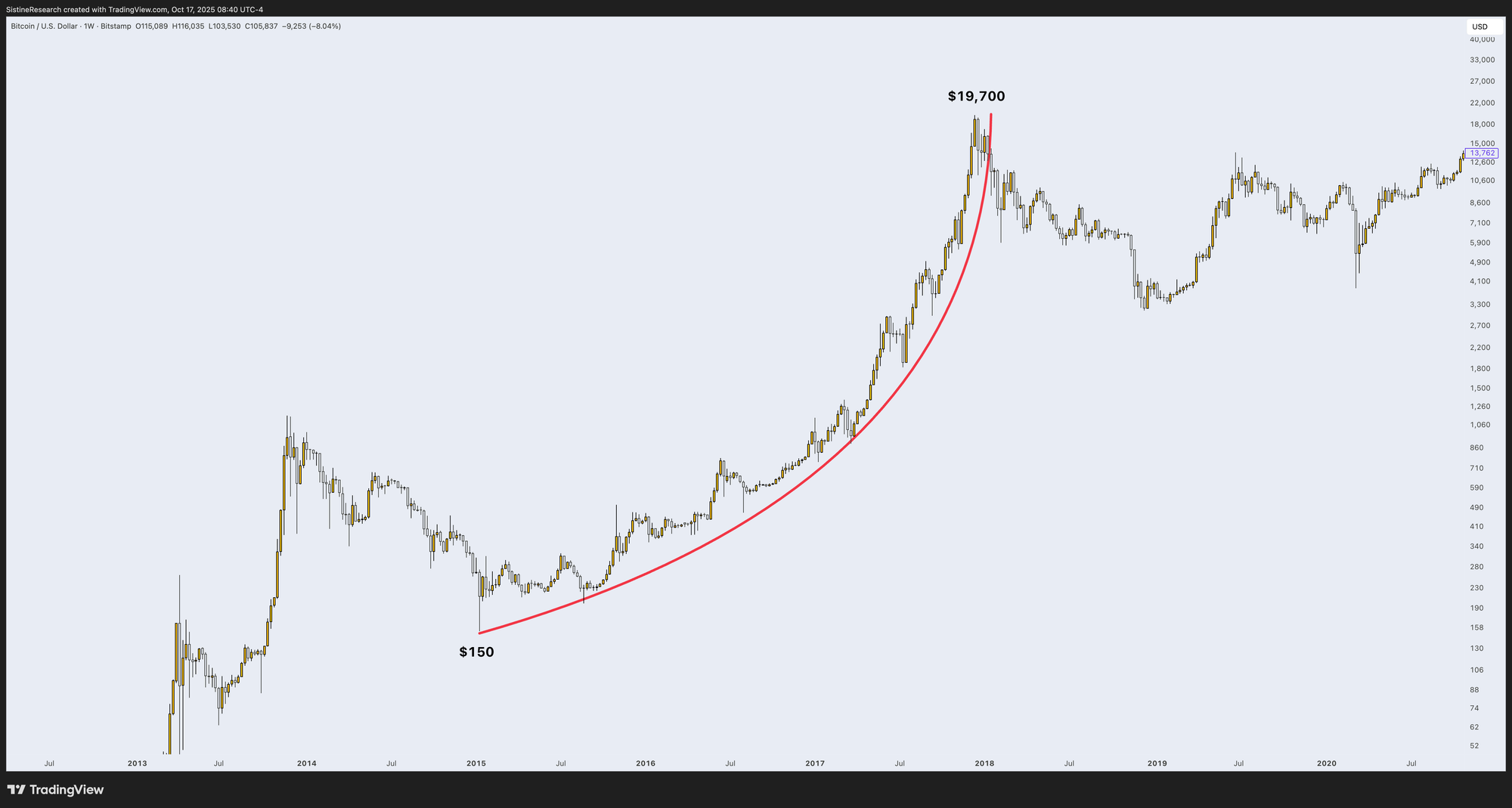

This is the hidden driver to most parabolic runs. Let's take BTC's parabolic blow off from 2015 - 2017 as an example:

During this time you had high demand present, but you also had rapidly expanding liquidity lines for BTC through many new exchanges coming online, but more importantly, BTC became used for altcoin liquidity pairs (primarily on Binance, but elsewhere too) and the altcoin bubble drove BTC significantly higher in a short period of time.

In 2017 we saw increased interest in altcoins like XRP, Ethereum, Dogecoin, Peercoin, etc. All of these altcoins were listed on Binance with BTC liquidity pairings such as ETH/BTC, DOGE/BTC, XRP/BTC. This became a huge supply sink for BTC as the prices of these altcoins rose, these altcoin/BTC orderbooks soaked up more and more BTC, constricting supply.

ETH experienced the same thing in 2020 and 2021 as the invention of DEXes like Uniswap led to a proliferation of ETH/ERC-20 liquidity pools forming, sinking large amounts of ETH into these pools. NFT speculation also played a role.

SOL experienced the same thing in 2023 and 2024 as memecoin mania drove large amounts of SOL into liquidity pools.

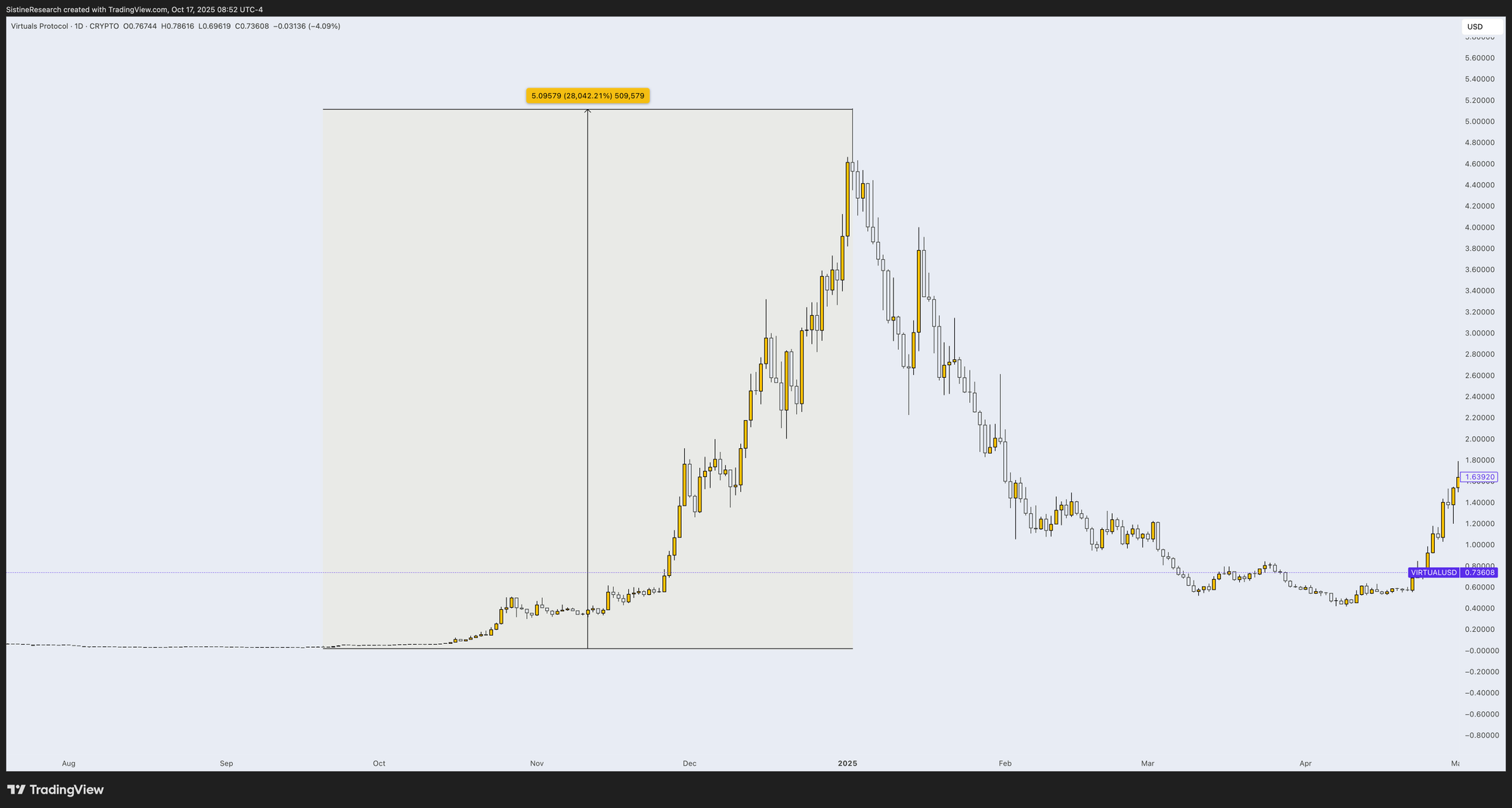

VIRTUAL experienced the same thing on Base in 2024 as the team opted to use VIRTUAL as their liquidity pair for token launches instead of ETH, leading to vast amounts of VIRTUAL getting soaked up into liquidity pairs like AIXBT/VIRTUAL. If you wanted to buy AIXBT, you had to buy VIRTUAL, thus driving the price of VIRTUAL up.

Rapidly expanding liquidity lines enable large amounts of money to flow into an asset in a short period of time, creating parabolic price action. Without expanding liquidity lines, an asset's price action is somewhat bottlenecked. Imagine trying to fill up a pool with a single garden hose vs 100 garden hoses.

Now that you understand the role rapidly expanding liquidity lines play in a parabolic run let's tie it back to gold.

China has systematically developed gold-focused financial infrastructure to reduce reliance on Western institutions. The Shanghai Gold Exchange (SGE) has expanded to become the world's largest physical gold exchange by trading volume, handling approximately 27,500 tonnes of gold in 2023 according to the exchange's annual report.

Unlike Western exchanges that primarily trade paper contracts, the SGE emphasizes physical delivery. In 2023, physical gold withdrawals from the SGE totaled approximately 2,000 tonnes, representing actual physical delivery to the Chinese market.

China has established extensive gold vaults and bonded warehouses to encourage international storage within its borders. This physical infrastructure supports a growing ecosystem of gold-backed financial products for both domestic and international markets, creating alternatives to Western gold trading hubs like London and New York.

In simpler terms, China wants to reduce dollar dependence in trade and encourage more trade that uses the Yuan. In order to do this, China is making it extremely easy to swap from the Yuan to physical gold with deep liquidity via an expanding network of physical gold vaults. Everyone trusts gold, so if it's easy to swap from the Yuan to gold, China's trade partners are more likely to trust the Yuan.

In order to establish these vaults and back their currency with gold liquidity, China has been buying significant amounts of physical gold over the past few years, reducing the supply on the open market.

Tying It All Together

Trump says 100% tariffs on China. Why? Likely because China has cornered the rare earth minerals market (and is the manufacturing capital of the world) and Trump wants negotiating leverage going into a meeting with Xi Jinping in a few weeks.

These tariffs project future debasement of both the Yuan and the Dollar. Chinese trade partners get spooked and quickly swap Yuan for gold thanks to China's growing gold vault infrastructure.

Investors globally get spooked and easily swap fiat for gold. Gold prices spikes driving FOMO among retail who go stand in lines to buy physical gold.

Large amounts of physical supply has already been taken off the market thanks to China's accumulation. (China has also been explicitly instructing its citizens to accumulate physical gold and silver for the last few years driving even more Yuan/Gold liquidity into their country and taking physical supply out of the orderbooks).

The US Fed has also been signaling more rate cuts and the end of QT in the coming months, projecting even more dollar debasement. Many investors have felt stocks are in a bubble and don't want to place money in the stock market. US treasuries, typically a risk-off asset of choice, have also performed poorly due the perception of a debt spiral in the US (the US is rapidly issuing more and more debt to cover spending, devaluing both the US dollar and US treasury bills).

This leaves metals like gold and silver as the ideal undervalued risk-off options that perform well during recessions, kinetic wars, trade wars, stagflation, debt collapse, and rapid fiat debasement.

Expectations Moving Forward

Some assumptions:

- The remainder of the Trump presidency is likely an ideal environment for gold to go higher in the next few years. He isn't afraid of chaos and will likely continue to push on China.

- The 100% tariffs on China are not sustainable for either side. They are a negotiating tactic and are likely removed or greatly reduced.

- China will continue to accumulate gold and support liquidity in the coming years as it greatly benefits the stability and strength of the Yuan.