Stagflationary Metals Supercycle

While most stocks and cryptocurrencies are down or break-even on the year for 2025, metals (Gold, Silver, Platinum, Palladium, Copper) have been outperforming all year long.

While most stocks and cryptocurrencies are down or break-even on the year for 2025, metals (Gold, Silver, Platinum, Palladium, Copper) have been outperforming all year long.

Metals historically outperform during stagflation (high inflation accompanied by low economic growth and high unemployment).

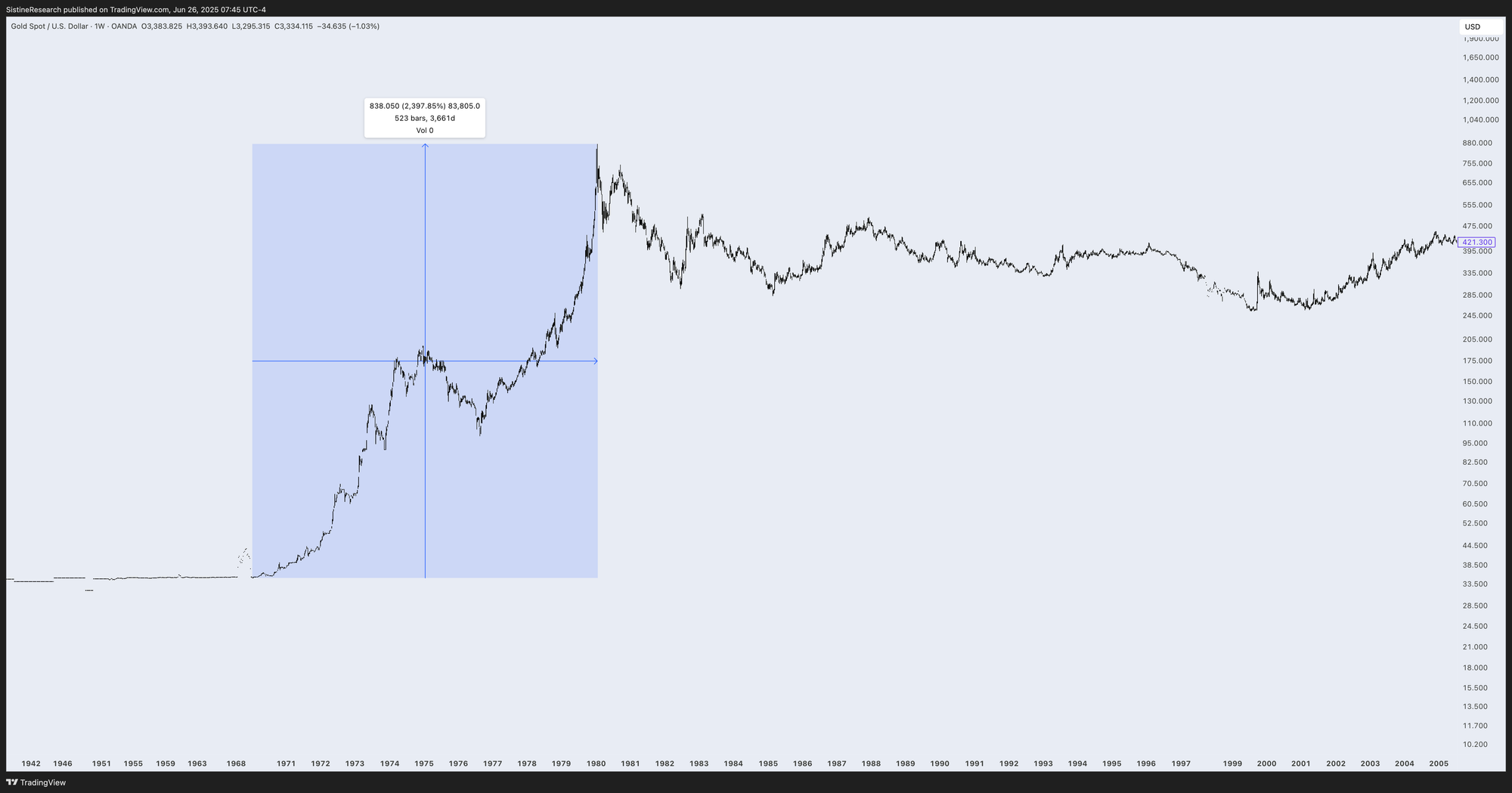

From 1970 - 1980, Gold returned 2400%.

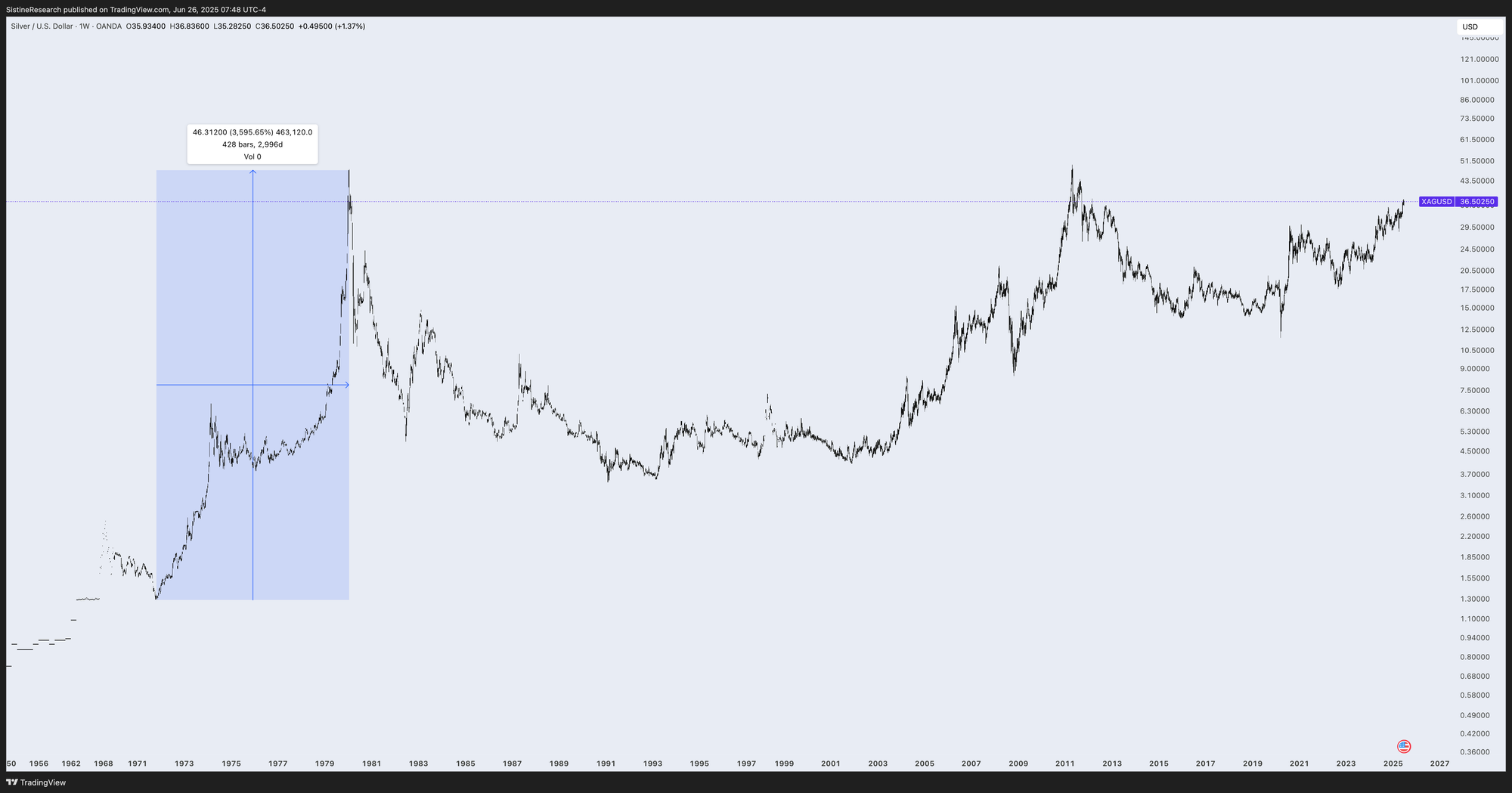

From 1970 - 1980, Silver returned over 3600%, or an average of 240% per year.

Platinum returned ~1000% in that time period.

A quick study on the stagflationary period of the 1970s: