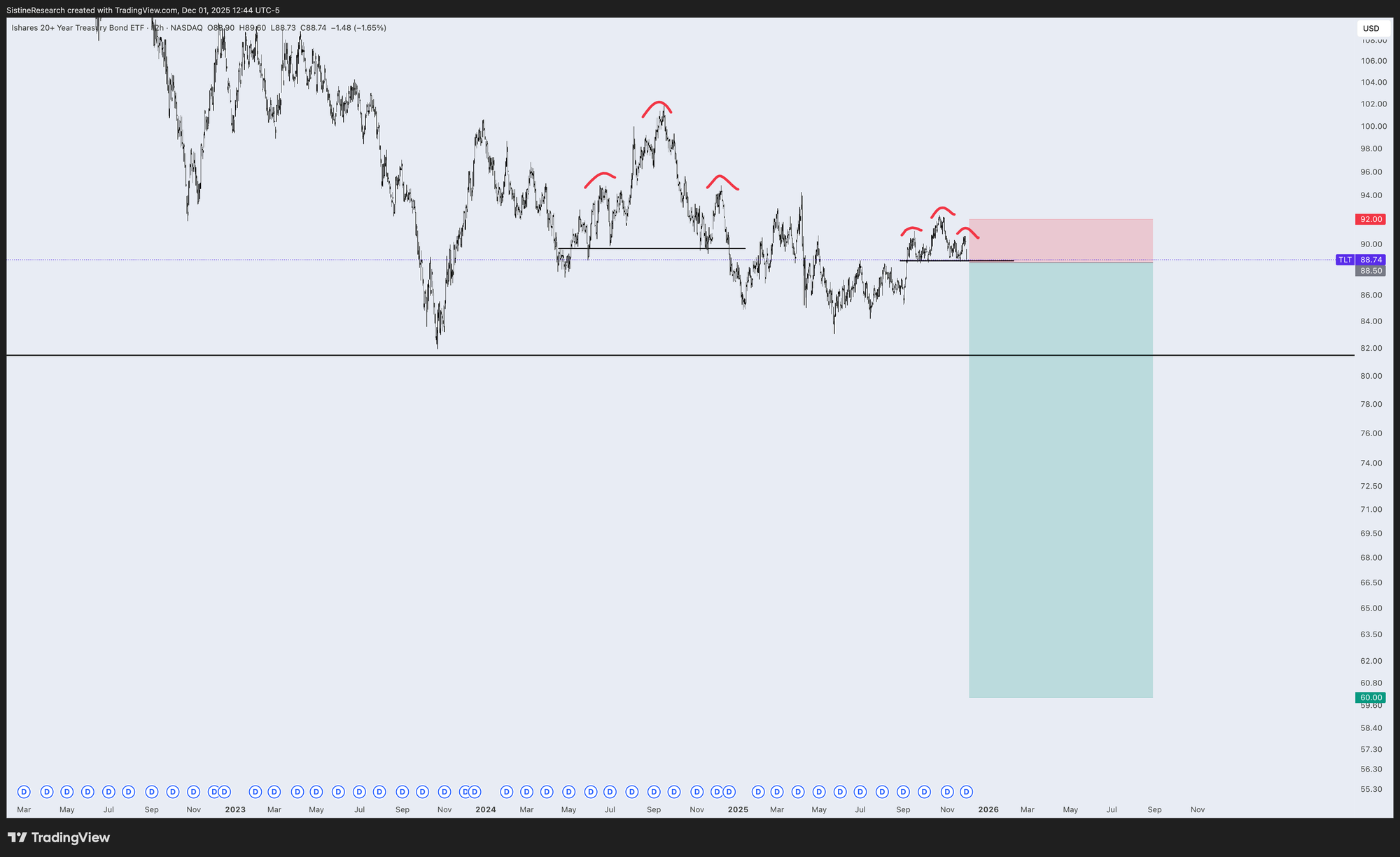

Trade Idea: $TLT

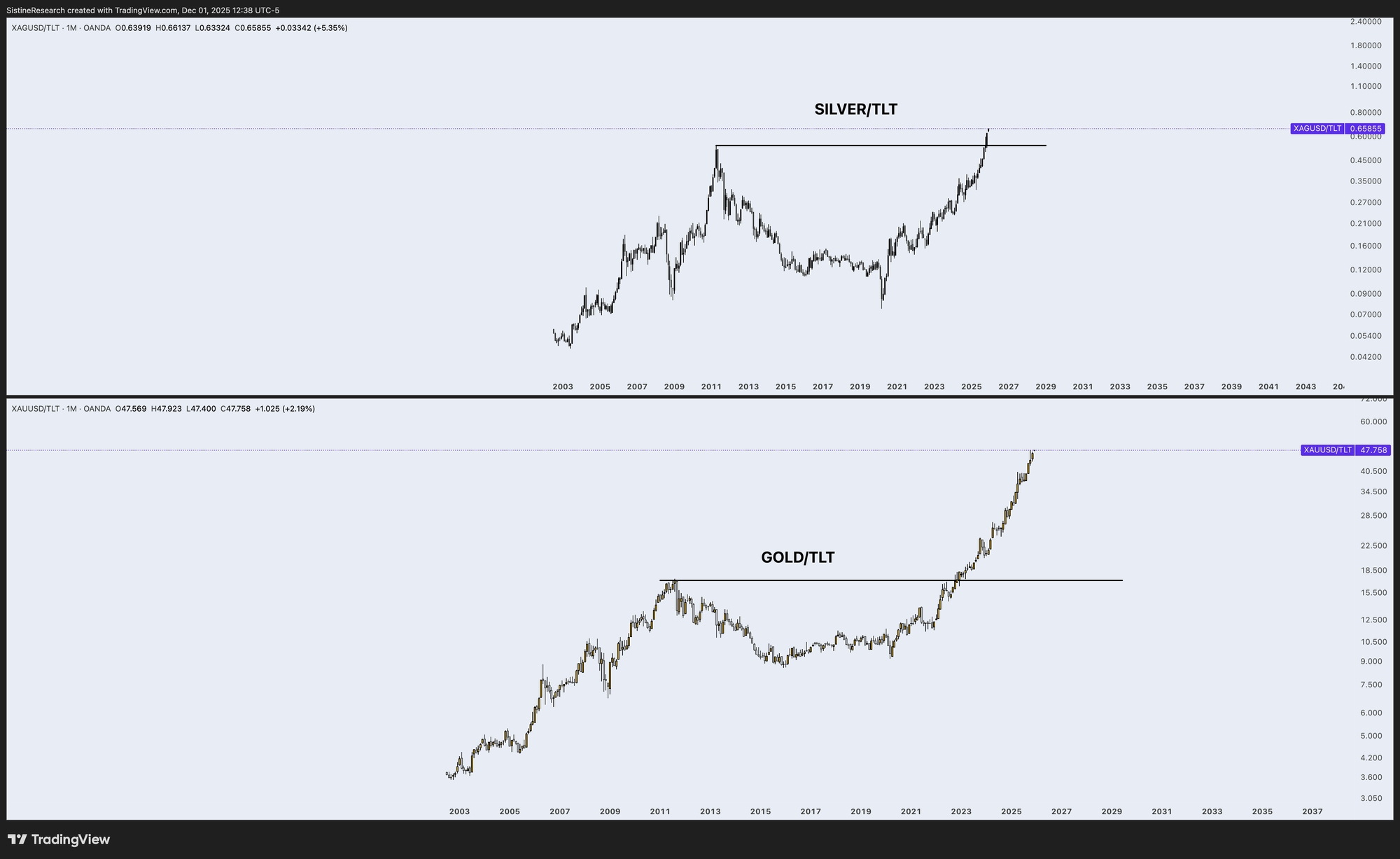

Silver and gold have both broken out against TLT (long term US treasuries).

This trend is likely to continue as the US faces a debt spiral. Currently, TLT is looking particularly weak with a head and shoulders breaking down:

🏷️ Name: iShares 20+ Year Treasury Bond ETF

💠 Ticker: $TLT

📈 Direction: Short

🎯 Entry: $88.5

🎯 Target: $60 or trailing stop loss

🛑 Stop Loss: $92

⚖️ Risk / Reward: 8: 1

Note: This trade is best paired with metals longs (gold, silver, platinum).

The Fiscal Dominance Arbitrage: Long Precious Metals, Short Long-Duration Treasuries

Executive Summary

The divergence between hard assets and sovereign debt has established itself as the defining macro-trade of the mid-2020s. This trade is driven by a structural regime shift toward "Fiscal Dominance"—a state where monetary policy is increasingly subordinate to the government's need to finance excessive deficits. With the U.S. debt-to-GDP ratio surpassing 120-135% and interest expenses exceeding defense spending, investors have demanded a higher "term premium" for holding long-dated government paper, crushing bond prices. Simultaneously, central banks have aggressively rotated reserves from Treasuries into gold to hedge against this very fiscal instability, while silver faces a fifth consecutive year of structural supply deficits driven by the solar industrial boom.

I. The Short Leg: The Structural Impairment of Long-Term Treasuries (TLT)

The bear case for long-duration U.S. Treasuries (TLT) rests on the deterioration of the U.S. fiscal position, which has fundamentally altered the risk-reward profile of government debt.

1. The Return of the Term Premium

For decades, the "term premium"—the extra yield investors demand to hold long-term bonds over short-term bills—was negligible. As of 2025, this premium has re-emerged as a primary driver of rising yields (and falling bond prices). The New York Fed and other institutions note that the rise in long-term rates is now driven largely by this premium rather than just inflation expectations, reflecting growing uncertainty about the government's long-term solvency.

2. Supply Saturation and Debt Service Costs

The supply of U.S. debt has overwhelmed demand. In 2025, the U.S. national debt exceeded $36 trillion, with debt-to-GDP projected to hit 156% by 2055. Net interest payments on this debt reached $900 billion in 2024, surpassing the entire U.S. defense budget. This creates a vicious cycle: the government must issue more debt simply to pay interest on existing debt, further saturating the market and forcing yields higher to attract buyers. Recent Treasury auctions have seen bid-to-cover ratios fall below 2.0x, signaling waning appetite from traditional buyers.

3. The "Maturity Wall"

Nearly half of the U.S. national debt matures within two years. Refinancing this debt at rates above 5% (compared to near-zero previously) mathematically guarantees higher future deficits, reinforcing the short-TLT thesis.

II. The Long Leg: Gold as the Sovereign Credit Hedge

Gold has decoupled from its traditional inverse correlation with real interest rates, signaling a shift in its role from a mere inflation hedge to a sovereign credit hedge.

1. The Breakdown of Real Rate Correlation

Historically, high real interest rates (nominal rates minus inflation) were negative for gold. However, in 2024 and 2025, gold prices surged to record highs even as real rates rose. This anomaly confirms that investors are prioritizing safety from fiscal debasement over yield opportunity costs.

- Driver: The market is pricing in "Fiscal Dominance," where the Fed will eventually be forced to cap yields (Financial Repression) to keep the government solvent, which would ignite the next leg of inflation.

2. Central Bank De-Dollarization

A critical driver of the "Long Gold" trade is the strategic rotation by global central banks. For the first time in decades, foreign central bank gold holdings have surpassed their holdings of U.S. Treasuries. Nations like China are systematically reducing exposure to the U.S. dollar and Treasuries, buying over 1,000 tonnes of gold annually to insulate their reserves from U.S. fiscal risks and sanctions.

III. The "Turbo" Leg: Silver's Industrial Scarcity

While gold hedges the monetary system, silver provides aggressive leverage through a unique structural supply deficit.

1. Solar Demand Shock

Silver demand has been radically altered by the green energy transition. The photovoltaic (PV) solar sector now consumes substantial portions of global supply, with demand from this sector growing at 14% annually. Despite manufacturers attempting to "thrift" (use less silver per panel), the sheer volume of installations has driven industrial demand to record highs.

2. Fifth Consecutive Year of Deficit

As of late 2025, the silver market is in its fifth consecutive year of structural deficit, with demand outstripping supply by nearly 117-200 million ounces annually. Unlike gold, silver is largely a byproduct of base metal mining (copper/zinc), making its supply inelastic; miners cannot easily ramp up production in response to price spikes.

3. Price Performance

Silver is up approximately 25.07% YTD in 2025, trading near $58/oz, driven by this physical scarcity and its high-beta relationship to gold.

IV. Why The Trade Will Continue to Outperform

The "Long Precious Metals / Short TLT" trade is not merely a cyclical bet but a structural hedge against a new economic era.

- Fiscal Math is Unforgiving: There is no political will in Washington for the austerity required to stabilize the debt. Deficits are forecast to remain above 6-7% of GDP indefinitely. This guarantees continued Treasury issuance (suppressing bond prices) and monetary debasement (supporting gold).

- Financial Repression is the End Game: If bond yields rise too high, they threaten U.S. solvency. The Fed may eventually be forced to intervene (Yield Curve Control). In this scenario, nominal yields are capped while inflation runs hot—the perfect environment for negative real yields, sending gold and silver parabolic.

- Positive Carry & Volatility Dampening: While shorting bonds has a cost (paying the yield), the appreciation of gold and silver has far outpaced these costs. The pair trade effectively neutralizes the volatility of a pure "deflationary crash" (where bonds would rally) or a pure "inflationary spiral" (where bonds crash), capturing the "stagflationary" delta where real assets outperform financial liabilities.

Conclusion

The convergence of fiscal dominance, industrial scarcity in silver, and geopolitical de-dollarization creates a robust foundation for maintaining the Long Gold/Silver vs. Short TLT position. As long as the U.S. government runs wartime-level deficits during peacetime, the bond market will struggle to find a clearing price without higher yields, while hard assets will continue to be repriced higher in dollar terms.

- Key Risk: A severe deflationary depression (which would temporarily favor TLT) or aggressive fiscal austerity (highly unlikely).